The Levies

On November 4th, 2014, residents of Richfield Village and Richfield Township will be voting on two levies related to Crowell Hilaka. One levy will fund the purchase and improvement of the property, and the other will fund continuing operation of the property.

For complete information about the levies, please visit the Richfield Together web site.

We have heard that there is a lot of confusion about exactly how much the levies will increase residents' taxes. Here is an attempt to explain how tax is calculated.

Taxes are based on the assessed value of your property, not on the appraised value. The assessed value is calculated by Summit County. It is different (and usually quite a bit lower) than the appraised value, which is an estimate of what you can get if you sell your house. The county calculates the value of your property, and then bases your taxes on a fraction of that value.

In Summit County, the current fraction is 35%.

One mill is one tenth of one percent of the taxable value of your property.

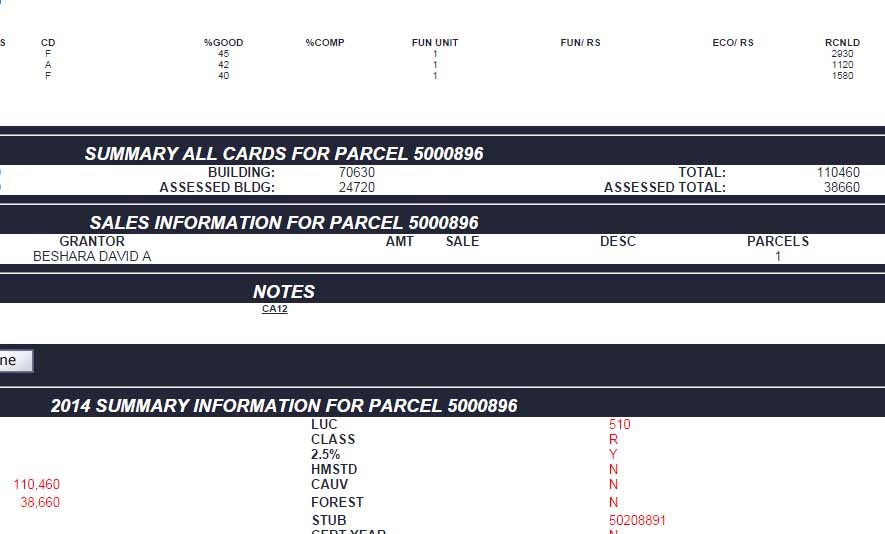

Here is a sample of a property in Richfield Village that was appraised at just under $200,000:

For complete information about the levies, please visit the Richfield Together web site.

We have heard that there is a lot of confusion about exactly how much the levies will increase residents' taxes. Here is an attempt to explain how tax is calculated.

Taxes are based on the assessed value of your property, not on the appraised value. The assessed value is calculated by Summit County. It is different (and usually quite a bit lower) than the appraised value, which is an estimate of what you can get if you sell your house. The county calculates the value of your property, and then bases your taxes on a fraction of that value.

In Summit County, the current fraction is 35%.

One mill is one tenth of one percent of the taxable value of your property.

Here is a sample of a property in Richfield Village that was appraised at just under $200,000:

As you can see from this view, the total value of this property calculated by Summit County was $110,000, and after applying the 35% fraction, the assessed value of this $200,000 appraised-value property is $38,000. One mill of tax on this property would cost $38/year, or just over $3/month.

Issue 10 is a 1.25-mill levy for the purchase of Crowell Hilaka, and to fund needed repairs and improvements to the property. If Issue 10 passes, the owner of this property would pay $48/year, or $12/month, for 28 years.

Issue 11 is a 0.5-mill, 10-year levy for funds to operate the Crowell Hilaka property. If Issue 11 passes, the owner of this property would pay $19.33/year, or about $1.50 per month.